U.S. Oncology Market to Surge from USD 81.34 Billion in 2025 to USD 211.78 Billion by 2034, Driven by Rising Cancer Burden

The U.S. oncology market size was valued at USD 72.79 billion in 2024 and is predicted to hit around USD 211.78 billion by 2034, rising at a 11.75% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Dec. 02, 2025 (GLOBE NEWSWIRE) -- The U.S. oncology market size is calculated at USD 81.34 billion in 2025 and is expected to reach around USD 211.78 billion by 2034, growing at a CAGR of 11.75% for the forecasted period, rising because cancer cases are increasing, and demand for advanced, personalized, and more effective treatments continues to grow rapidly.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6377

Key Takeaways:

- U.S. oncology market to crossed USD 72.79 billion by 2024.

- Market projected at USD 211.78 billion by 2034.

- CAGR of 11.75% expected in between 2025 to 2034.

- The West region led the U.S. oncology market with nearly 34% revenue share in 2024.

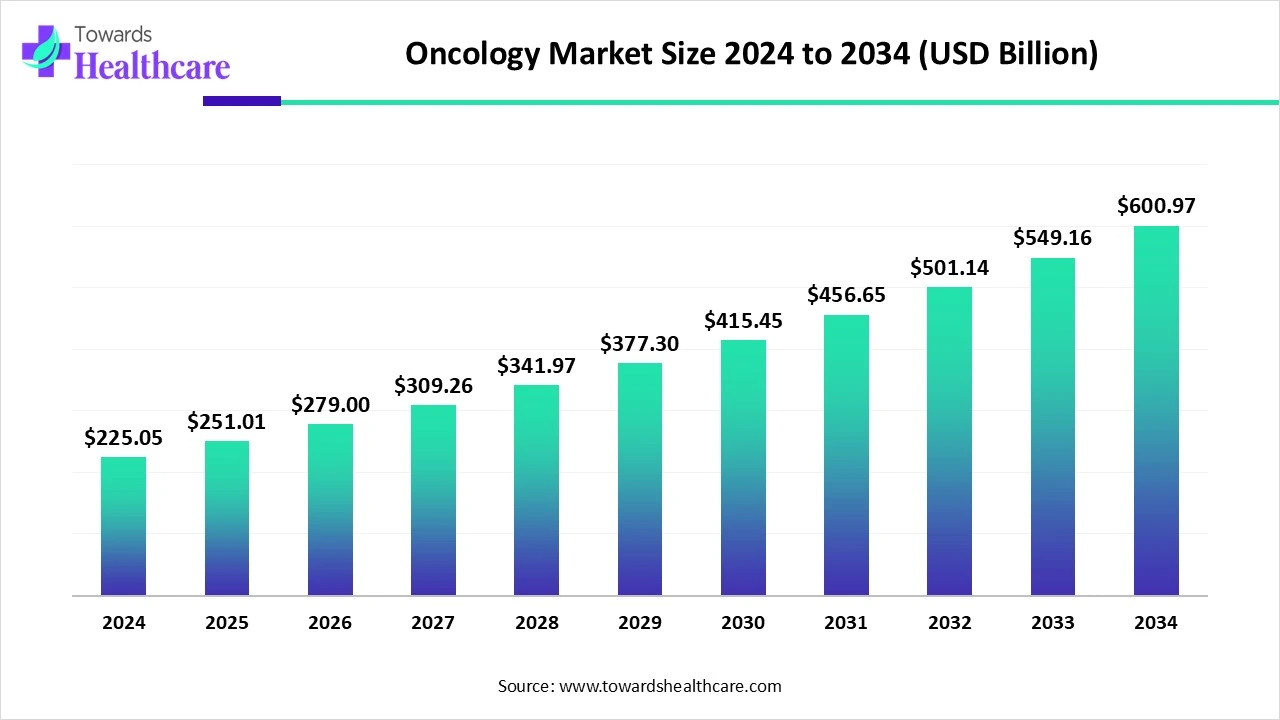

- The global oncology market is valued at US$ 225.05 billion in 2024 and is projected to reach US$ 600.97 billion by 2034, growing at a CAGR of 11.54%.

- The South region is expected to grow rapidly during the forecast period.

- By cancer type, the breast cancer segment dominated with an approximate 22% share of the market in 2024.

- By cancer type, the leukemia segment is expected to be the fastest-growing in the coming years.

- By therapy type, the targeted therapy segment captured nearly 28% revenue share of the market in 2024.

- By therapy type, the immunotherapy segment is expected to witness rapid expansion during 2025-2034.

- By modality/drug class, the monoclonal antibodies (mAbs) segment held nearly 30% share of the U.S. oncology market in 2024.

- By modality/drug class, the CAR-T cell & gene therapies segment is expected to grow at a rapid CAGR during the forecast period.

- By end user, the hospitals & cancer specialty centers segment dominated with an approximate 48% revenue share of the market in 2024.

- By end user, the academic & research institutions segment is expected to be the fastest-growing during 2025-2034.

- By distribution channel, the hospital pharmacies segment held approximately 41% share of the market in 2024.

- By distribution channel, the specialty pharmacies segment is expected to be the fastest-growing during 2025-2034.

Market Overview:

What Is the Current Size of the U.S. Oncology Industry and What is Its Growth Potential?

The U.S. oncology business has rapidly expanded in size and growth potential. The increasing number of patients diagnosed with cancer, coupled with the fast-paced research and development of new technologies being developed and adopted by hospitals, clinics, and other clinical oncology facilities; the growing investment in precision medicine; the emergence of new classes of targeted drug therapies; and an overall favorable regulatory environment are also all reasons behind the expansion of the U.S. oncology sector. The ongoing expansion of access to cancer screening, diagnostic technologies for cancer detection, and increasing awareness of the importance of early detection of cancers drive the overall expansion of the U.S. oncology market.

Biologics and pharmaceuticals are developing and will continue to develop innovative and novel treatments and therapies for cancer, including monoclonal antibodies, cellular therapies, and next-generation immunotherapies, and the emerging trends within the U.S. oncology environment will support continued expansion and innovation in the coming decade.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Major Growth Drivers:

Which Are The Primary Contributors Towards The Quickly Rapid Growth of The U.S. Oncology Sector?

- Growth in the incidence of cancer along with the aging population: The increase in the incidence of cancer particularly among the older population has created a significant ongoing demand of oncology-related drugs, therapies, and long-term treatment solutions.

- Innovations In Precision Medicine: Recent advancements in genomic profiling, and establishment of biomarker-targeted therapies, have provided practising physicians, with a greater ability to individualise their patient’s therapy and therefore, incentivise an increased utilisation of more targeted therapies.

- Strengthened Research And Development Pipeline: The increased investment by biotechnology and pharmaceutical companies arises from growing levels of consumer confidence and leads to an increased rate of innovation, with many new oncology drugs entering clinical trials and subsequently being made available for approval annually.

- Strong Regulatory Environment: Utilisation of the FDA’s accelerated approval pathways and oncology-related programmes have enabled timely and efficient commercialisation of significant oncology-based drugs and oncological biologics.

-

Expansion of Advanced Care Centres: The increase in number of hospitals, cancer research centres, and treatment facilities throughout the U.S. has improved access to advanced oncology services for patients in the U.S.

Key Drifts for U.S. Oncology Market:

Various oncology organizations in the United States report that there is a major movement away from standard drug therapies and toward innovative, more accurate, and less toxic types of cancer treatment. With the increased adoption of biological drugs (like monoclonal antibodies) and monoclonal antibody conjugates (MADCs), as well as cellular and gene therapy (CGT), including CAR-T therapies, there has been a revolutionary shift in the treatment model for cancer and the introduction of new standards of care within the oncology community.

The introduction of digital diagnostics, artificial intelligence tools for improving cancer screening, remote patient monitoring, and evaluation of treatment through technology are all improving the overall precision of cancer therapies. Further, through collaboration between pharmaceutical companies and academic research organisations, the time required to develop and bring to market new cancer drugs via clinical trials has been significantly reduced.

Significant Challenge:

The highest barrier in today's U.S. oncology market is the exorbitant cost associated with novel personalised medicine (NPM) therapies (e.g., CAR-T therapies and long-course of care). Patients experience substantial financial burden caused by NPM therapies despite insurance coverage from third-party payers and these therapies also contribute to differences in treatment outcomes due to the limited number of treatment centres providing access to NPM(s) in rural or underserved regions. Thus, affordability and accessibility to NPM oncology technologies remain significant obstacles to widespread utilisation and acceptance of NEXTGEN oncology solutions.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Regional Analysis:

The Western U.S. covers the widest range of Biotechnology Investment, Supporting Infrastructure, and Pharmaceutical & Research Organizations. California & Washington states remain leaders in Clinical Trials and Collaboration in Cancer Specialty Medical Innovations. Southern States are on track to being the fastest-growing Marketplace for Oncology due to rapidly expanding cancer care Network growth, population growth, improved health Care Facilities, more Early Diagnosis Demand, and increased demand for Advanced Treatment. The efforts of the Government and the Private Sector to build Up Oncology Capacity will greatly Accelerate the Marketplace Growth in Texas, Florida, and Georgia.

Global Oncology Market Growth

The global oncology market is valued at US$ 225.05 billion in 2024, expected to grow to US$ 251.01 billion in 2025, and projected to reach approximately US$ 600.97 billion by 2034. This growth represents a compound annual growth rate (CAGR) of 11.54% from 2025 to 2034.

Segmental Insights:

By Cancer Type:

Breast Cancer will account for approximately 22% of the Oncology Marketplace in 2024. Many factors have attributed to Breast Cancer remaining the Major Type of prognosis. First, there has been a high participation rate of Breast Cancer screenings with a Consistent Growth Rate of Mammography. In Addition, there has been a Significant Amount of effort placed toward creating National Awareness for Breast Cancer by several Healthcare Organizations. The chance of continuing to maintain the Market Leadership of this type of Cancer Segment is due to the continued Improvement of Published Standard Treatment Protocols. The Utilization of Tamoxifen, targeted Therapy for HER2 Positive Breast Cancer; and HER2 Targeted Monoclonal Antibody Drug Conjugates that are in Phase III Trials for this Cancer Segment, will Maintain the Leadership of this Segment of the Marketplace.

Leukemia will be the Fastest Growing Cancer Segment Over the Next Several Years due to the Continuously Increasing Advances made in the Blood Cancer Treatment space. Developments in the creation of Targeted Therapies, Advances in the Gene-Editing arena, and resulting advances in the CAR-T Cell Therapy industry will enable significantly Improved Treatment Options for Patients diagnosed with Leukemia. As a Result of the many Increasing Efforts placed into Hematologic Oncology research and Clinical Trials, the effectiveness of Providing Treatment for patients diagnosed with this Disease will accelerate over the coming 1-2 years.

By Therapy Type:

With targeted therapies taking 28% revenue share in 2024, they will capture the most revenue share of any therapy type segment in the U.S. oncology market. By precisely attacking cancer cells based on specific genetic mutations or molecular markers, targeted therapies have higher success rates and fewer side effects. The increasing acceptance of targeted therapies by healthcare providers across several different cancers, such as lung, breast, colorectal and many others, has increased demand for these types of therapies. The availability of companion diagnostics has driven up the number of targeted therapies used.

The fastest growing therapy type from 2025–2034 will be immunotherapy. Immunotherapy uses the patient’s own immune system to identify and destroy the patient’s cancer. Immunotherapy has the potential to provide a higher quality of care to patients with previously untreatable cancer. The recent uptick in regulatory approvals for checkpoint inhibitors, cancer vaccines and CAR-T cells has led to many cancer patients being treated with immunotherapy. Due to its ability to achieve long-term remissions and versatility across a wide range of cancers, immunotherapy is likely to be the preferred choice for both patients and health care professionals over the next decade due to ongoing discoveries about combination therapy in the research community.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By Mode / Drug Class:

Monoclonal antibodies account for nearly 30% of the U.S. oncology market in 2024, making mAbs the leading drug class in oncology. The use of monoclonal antibodies (mAbs) for the treatment of specific solid tumors and hematologic malignancies, especially breast cancer, lymphoma, and colorectal cancer, is well documented and based on clinical evidence of their high specificity and clinical efficacy. Pharmaceutical innovation in the development and improvements to the use of mAbs has continued to produce refined medications, such as antibody-drug conjugates (ADRs), bispecific mAbs and next-generation mAbs with greater precision of targeting tumor cells.

The fastest-growing mode/drug class during the forecast period 2025–2034 will be cell and gene therapies, especially CAR-T cells. Cell and gene therapies have the ability to transform the treatment of aggressive, treatment-resistant cancers by using modifications to the patient’s own immune cells to specifically identify and destroy cancer cells. Developing investment in gene engineering, increased production capacity, and ongoing clinical trials will lead to greater adoption rates for CAR-T cell therapies.

By End User:

The leading user segment in terms of market share is hospitals and cancer specialty centers, which made up around 48% of the market share in 2024 as they have the broadest range of oncology capabilities due to their multiple disciplines and state-of-the-art equipment used in providing oncology care, resulting in many cancer patients visiting them for top-level care. The availability of clinical trials, the latest therapies and accredited cancer programs consolidate their market leadership position. In addition, many cancer specialty centres provide patients with an individualised treatment plan along with the most advanced technology, such as radiation therapy and genomic testing, creating a high level of patient loyalty.

The academic and research institution end user segment is anticipated to grow fastest over the 2025-2034 period as these institutions play an essential role in conducting clinical trials for the development of new oncology therapies as well as developing new drugs from early stages to the clinical trial phase. Academic and research institutions are working with biotechnology companies to expedite the development of next-generation oncology therapeutics, and as a consequence will continue to grow quickly as funding becomes increasingly available for oncology and experimental therapies.

By Distribution Channel:

The other major segment for 2024 is hospital pharmacies, which accounted for 41% of the distribution share in 2024. Hospital pharmacies are critical to the management of oncology due to their ability to supply sophisticated drug protocols in the hospital setting, including compliance with the administration of many complex oncology medications including chemotherapy, biologics, and infusion-based treatments. The hospital pharmacy also has a close association with the oncology department.

Specialty pharmacies will emerge as the fastest-growing pharmacy distribution channel. Specialty pharmacies are dedicated to the handling of complex, high-value oncology drugs that necessitate careful control of the storage and administration of drugs, as well as providing programs to assist patients with drug administration. Additionally, specialty pharmacies are ideally suited to provide assistance to patients on long-term therapies; they work with patients to obtain insurance approval of the medication, ship medications from the pharmacy directly to the patient.

Browse More Insights of Towards Healthcare:

The global oncology drugs market size is estimated at US$ 204.39 billion in 2024, is projected to grow to US$ 217.18 billion in 2025, and is expected to reach around US$ 360.79 billion by 2034. The market is projected to expand at a CAGR of 6.29% between 2025 and 2034.

The global oncology API market size is calculated at USD 41.79 billion in 2024, grew to USD 43.95 billion in 2025, and is projected to reach around USD 69.55 billion by 2034. The market is expanding at a CAGR of 5.24% between 2025 and 2034.

The global oncology biomarker market size is calculated at US$ 34.16 billion in 2024, grew to US$ 38.62 billion in 2025, and is projected to reach around US$ 113.54 billion by 2034. The market is expanding at a CAGR of 12.73% between 2025 and 2034.

The global oncology devices market size is calculated at US$ 150.35 billion in 2024, grew to US$ 177.17 billion in 2025, and is projected to reach around US$ 776.3 billion by 2034. The market is expanding at a CAGR of 17.84% between 2025 and 2034.

The oncology drug discovery market is poised for significant expansion from 2024 to 2034, driven by rapid advancements in precision medicine, AI-enabled drug development, and a growing pipeline of targeted therapies.

The global oncology automation market size is calculated at US$ 2.82 billion in 2024, grew to US$ 3.12 billion in 2025, and is projected to reach around US$ 7.77 billion by 2034. The market is expanding at a CAGR of 10.68% between 2025 and 2034.

The global oncology NGS market size was calculated at US$ 508.95 million in 2024, grew to US$ 589.01 million in 2025, and is projected to reach around US$ 2,193.49 million by 2034. The market is expanding at a CAGR of 15.73% between 2024 and 2034.

The global oncology clinical trial market size recorded US$ 13.64 billion in 2024, set to grow to US$ 14.36 billion in 2025 and projected to hit nearly US$ 22.85 billion by 2034, with a CAGR of 5.30% throughout the forecast timeline.

The global oncology molecular diagnostics market size is calculated at USD 3.48 billion in 2025, grew to USD 3.90 billion in 2026, and is projected to reach around USD 10.93 billion by 2035. The market is expanding at a CAGR of 12.13% between 2026 and 2035.

The global oncology companion diagnostic market size is calculated at USD 5.24 in 2024, grew to USD 5.7 billion in 2025, and is projected to reach around USD 12.07 billion by 2034. The market is expanding at a CAGR of 8.73% between 2025 and 2034.

Recent Developments:

In September 2025, the Merck & Co. gained FDA approval for a new subcutaneous formulation of its immunotherapy Keytruda (marketed as Keytruda Qlex), allowing patients to receive treatment through an injection under the skin — a major convenience improvement over traditional IV infusion and likely to accelerate patient uptake.

U. S. Oncology Market Key Players List:

- Novartis AG

- Johnson & Johnson (Janssen Oncology)

- Gilead Sciences

- AstraZeneca plc

- Eli Lilly and Company

- Seagen Inc.

- Regeneron Pharmaceuticals

- Sanofi S.A.

- Takeda Oncology

- AbbVie Inc.

- Blueprint Medicines

- Exelixis Inc.

- BeiGene USA

- Exact Sciences Corp.

- Illumina Inc. (Oncology Genomics & Diagnostics)

Segments Covered in the Report

By Cancer Type

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Prostate Cancer

- Leukemia

- Lymphoma

- Ovarian & Cervical Cancer

- Others

By Therapy Type

- Chemotherapy

- Targeted Therapy

- Immunotherapy

- Hormonal Therapy

- Radiation Therapy

- Others

By Modality/Drug Class

- Monoclonal Antibodies (mAbs)

- Small Molecule Inhibitors

- CAR-T Cell & Gene Therapies

- Cancer Vaccines

- Inhibitors

- Others

By End User

- Hospitals & Cancer Specialty Centers

- Ambulatory Surgical Centers

- Diagnostic Laboratories

- Pharmaceutical & Biotech Companies

- Academic & Research Institutions

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Specialty Pharmacies

- Online Pharmacies

- Others

By Country (U.S.)

- West

- Northeast

- Midwest

- South

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6377

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.